Interest Rates Hit 5%

Interest rates increase to 5%

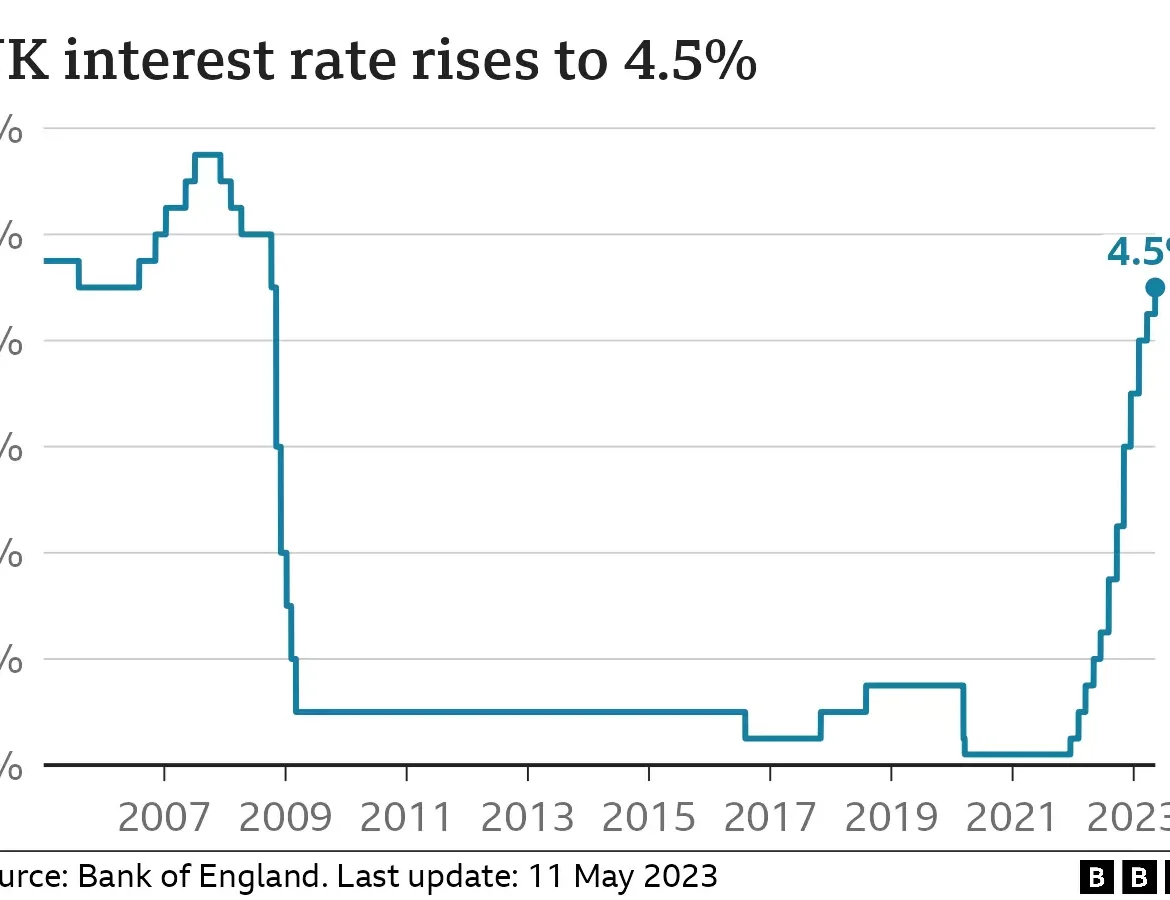

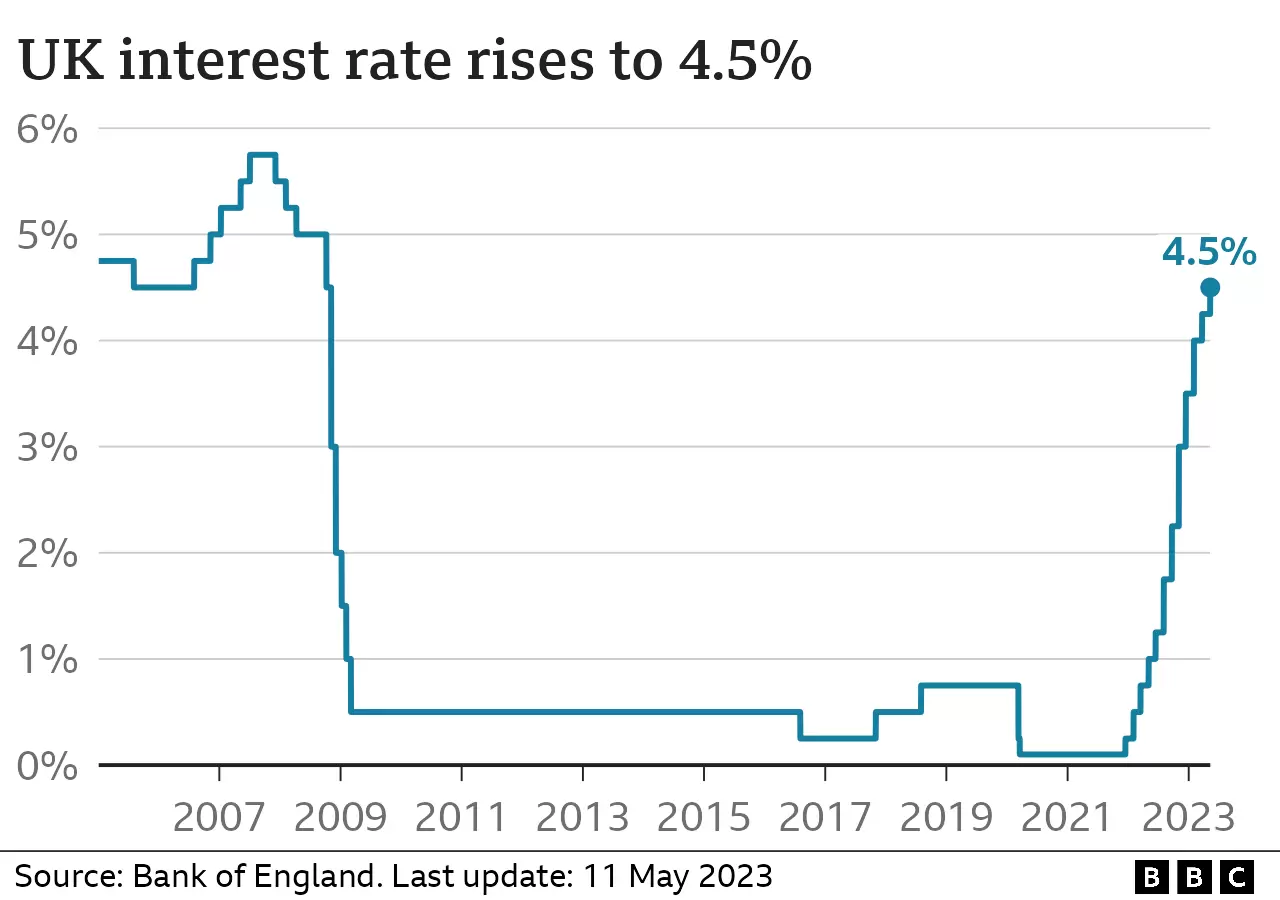

The Bank of England has raised its base rate from 4.5% to 5%, marking its 13th consecutive hike as it battles stubborn inflation. The move follows yesterday’s inflation figures, where the Consumer Prices Index (CPI) rose by 8.7% for the 12 months to May 2023, defying expectations for a fall.

Although many forecasters expected a hike, the 0.5 percentage point increase is larger than anticipated. The Monetary Policy Committee (MPC) voted by a majority of 7-2 to increase the base rate, with two members preferring to maintain the rate at 4.5%.

Why keep increasing rates?

The Bank of England is raising interest rates to try to counteract stubborn inflation. The rate of CPI inflation has remained at 8.7% in both the year to April and to May, which is over four times the Bank’s 2% target. Increasing interest rates is one of the tools that the Bank uses to try to bring inflation down. By making it more expensive to borrow money, people have less to spend, which reduces demand and eases price rises. It was expected that the Bank would raise rates to either 4.75% or 5%.

Is there anything else the BoE or the government could do?

Raise Taxes and Cut Spending

According to Laura Suter, head of personal finance at AJ Bell, the UK government has several options to tackle inflation, but all of them are “very unpalatable”. One of the options is to increase taxes and cut public spending, similar to a second round of austerity. Prime Minister Rishi Sunak could choose to raise taxes, cut government spending, or reduce the cost of living payments to reduce household spending, but these options could put further pressure on households already struggling to make ends meet. These options may also be politically unpleasant with a general election looming.

Head of personal finance at Hargreaves Lansdown, Sarah Coles, suggests that the government could take steps to “suck more money out of the economy,” but this would be a pretty brutal option as it would mean hitting the living standards of millions of people already at breaking point. Furthermore, this option may push the UK into a recession, causing job losses and leaving some people facing even more impossible circumstances. The government might also intervene to “strengthen the pound” in order to cut the costs of imports, but this would also come at a cost and would depress exports. This option would only be considered as a last-ditch effort if there were worrying falls in the pound in the coming weeks.

Quantitative Tightening

Quantitative tightening is a monetary policy tool used by central banks to reduce the amount of money circulating in the economy. This is done by selling the government bonds or securities that the central bank holds, which reduces the amount of money in circulation and can help to decrease inflation. The Bank of England could ramp up its quantitative tightening program as one option to reduce inflation.

Personally I still think raising interest rates is not the right thing to be doing in order to reduce inflation. As I have said before, the current high level of inflation is being driven by the cost of living increasing – in fact, perhaps we should rename this to the ‘cost of surviving’ which is essentially what it is for many people.

Inflation is so high due to the soaring costs of food & energy, caused by energy companies profiteering and the shortage of supplies following the lockdowns and the war in Ukraine which has reduced the availability of grain.